BTC Price Prediction: Analyzing the Path to $200,000 Amid Market Divergence

#BTC

- Technical Consolidation: BTC is testing key moving average resistance with mixed momentum signals suggesting near-term consolidation before potential breakout

- Institutional Momentum: Continued large-scale purchases by entities like MicroStrategy and potential undisclosed nation-state accumulation provide strong underlying demand support

- Network Fundamentals: Record hashrate achievement demonstrates unprecedented network security while improving accessibility drives broader adoption

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Moving Average

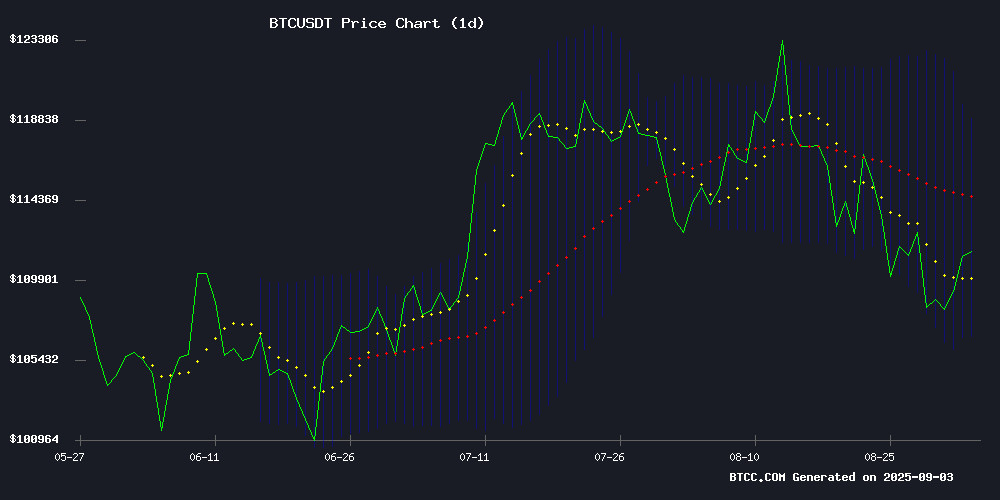

BTC is currently trading at $111,530, slightly below the 20-day moving average of $112,851, indicating potential short-term resistance. The MACD reading of 3,571.02 versus the signal line at 3,329.28 shows bullish momentum remains intact, though the histogram at 241.74 suggests some weakening. Bollinger Bands position the price between $118,933 (upper) and $106,769 (lower), with the current price sitting closer to the middle band, signaling consolidation. According to BTCC financial analyst Emma, 'The technical picture suggests BTC is in a holding pattern around key technical levels. A sustained break above the 20-day MA could signal renewed upward momentum.'

Market Sentiment: Institutional Accumulation and Hash Rate Strength Support Bullish Outlook

Recent news flow reinforces positive market sentiment despite current price volatility. MicroStrategy's additional $450 million Bitcoin purchase and speculation about Middle Eastern nation accumulation highlight continued institutional demand. The record 1 ZettaHash hashrate demonstrates unprecedented network security, while simplified access through platforms like MoonPay expands retail participation. BTCC financial analyst Emma notes, 'The underlying fundamentals remain strong with institutional adoption accelerating. While short-term volatility persists, the structural demand drivers appear intact, supporting a constructive long-term view.'

Factors Influencing BTC's Price

Gold’s Record Run Sparks Debate Over Bitcoin’s Next Move

Gold’s surge to all-time highs has reignited the debate about its implications for Bitcoin. Some analysts interpret the metal’s strength as a bullish signal for crypto, while others see it as a sign of Bitcoin’s vulnerability against traditional safe-haven assets.

Macro traders argue that gold’s breakout is part of a broader liquidity cycle, with Bitcoin historically playing catch-up after initial volatility. Earlier this year, gold’s push toward $3,500 preceded a sharp rebound in Bitcoin, fueling expectations of a repeat performance.

Skeptics, however, view the rally as a competitive threat. Critics like Peter Schiff highlight gold’s rise past $3,480 and silver’s climb above $40 as evidence of capital flowing away from digital assets. Bitcoin’s slip below $108,000 further underscores this divergence.

The rally in gold is driven by expanding global liquidity—estimated at over $130 billion in a single week—and persistent inflation concerns. This influx of capital has energized risk assets, leaving markets to weigh whether Bitcoin will follow or falter.

Former Grayscale ETF Chief David LaValle to Lead CoinDesk Indices in Institutional Push

David LaValle, a seasoned ETF industry veteran, has been appointed president of CoinDesk Indices and Data by Bullish (BLSH), the parent company of CoinDesk. LaValle's four-year tenure at Grayscale Investments as global head of ETFs was marked by his pivotal role in converting the Grayscale Bitcoin Trust (GBTC) into a spot bitcoin ETF—a landmark achievement following a court ruling against the SEC.

Prior to Grayscale, LaValle helmed VettaFi and held senior positions at State Street Global Advisors and Nasdaq, where he shaped the exchange-traded product marketplace. His expertise spans listed products and index businesses, making him a strategic hire for CoinDesk Indices as it cements its position as a leading digital asset benchmark provider.

BTC Price Prediction: Analysts Divided on Bitcoin's Next Move Amid Market Volatility

Bitcoin's price trajectory has become a focal point for investors as it fluctuates above $109,000 following weeks of heightened volatility. Market participants are split on whether the cryptocurrency will surge toward $125,000 or retreat to $100,000. Key technical levels suggest a breakout above $112,000 could propel BTC to $116,000, with $125,000 emerging as the next major target. Conversely, a drop below $107,000 may signal a slide toward $104,000, putting the $100,000 threshold in play.

The Relative Strength Index (RSI) at 41 reflects weak momentum, yet bullish divergence on the 4-hour chart hints at potential recovery. Analysts like Ali Martinez caution that Bitcoin's current structure mirrors patterns seen in 2021, where similar breakdowns preceded sharp corrections. Institutional demand remains a stabilizing force, with ETF inflows totaling $440 million last week alone.

While Bitcoin dominates market discussions, altcoins like Remittix are gaining traction. The project has raised $23.3 million through token sales, underscoring growing investor appetite for alternative digital assets.

Michael Saylor Buys Bitcoin Dip; What Does He Know?

Michael Saylor's MicroStrategy has quietly bolstered its Bitcoin holdings, acquiring 4,048 BTC for $449.3 million amid market uncertainty. The purchase, executed at an average price of $110,981, brings the company's total stash to 636,505 BTC—valued at over $70 billion. This move edges MicroStrategy closer to surpassing Satoshi Nakamoto's legendary holdings.

The timing raises questions. Saylor's accumulation coincides with growing macroeconomic unease. Global monetary policies, particularly the Fed's potential rate cuts by September 2025, appear to be a factor. Analysts suggest these cuts may reflect debt management struggles rather than economic optimism. Bitcoin's role as an inflation hedge—now increasingly favored over gold—adds context to Saylor's conviction.

CryptoAppsy Delivers Real-Time Market Insights for Agile Investors

CryptoAppsy emerges as a critical tool for cryptocurrency investors navigating the market's relentless volatility. The mobile application aggregates real-time pricing data across thousands of assets—from Bitcoin's $110,531 valuation to emerging altcoins—with sub-second latency through its exchange-agnostic infrastructure.

Portfolio tracking features enable manual position logging with live valuation updates, while customizable alerts notify users of predetermined price thresholds. The platform's historical charting functionality provides technical traders with millisecond-accurate candlestick data without requiring account creation.

Coinbase Exec Suggests Middle Eastern Nations May Be Accumulating Bitcoin Beyond Disclosures

Eric Peters, Chief Investment Officer at Coinbase Asset Management, revealed on the Bankless podcast that Middle Eastern nations likely hold significantly more Bitcoin than their official disclosures indicate. Sovereign wealth funds and central banks in the region appear to be building crypto reserves quietly, potentially positioning digital assets as part of a new monetary standard alongside gold.

Peters anticipates institutional FOMO will drive late entrants into Bitcoin at substantially higher price points. Current resistance persists around the $100,000-$120,000 range, with traditional investors still favoring equities even if BTC retraces below $85,000. The gradual maturation of crypto as a reserve asset class continues beneath the surface of public markets.

MoonPay and Interac Simplify Crypto Purchases for Canadians

MoonPay has partnered with Interac to enable Canadian users to buy cryptocurrencies using Interac e-Transfer®, a payment method widely used for everyday transactions. This integration allows direct purchases in Canadian dollars, eliminating currency conversion hassles.

The collaboration with Paramount Commerce streamlines the process: users select their bank, approve the transaction, and gain instant access to crypto. Ivan Soto-Wright, MoonPay's CEO, emphasized Canada's rapid crypto adoption and Interac's dominance in local payments.

Key features include real-time settlements via Interac e-Transfer for Business, CAD-native checkout without hidden fees, and the security of traditional banking infrastructure. Bitcoin is explicitly mentioned as a supported asset.

Bitcoin's 7-Day Average Hashrate Hits 1 ZettaHash for First Time

Bitcoin's hashrate has achieved a historic milestone, reaching 1 zettahash per second (1 ZH/s) on a seven-day moving average for the first time. This new all-time high, reported by Glassnode, underscores the relentless growth of the network's computational power.

The seven-day moving average smooths out natural variability in block times, providing a clearer picture of the network's sustained performance. While the 1 ZH/s threshold has been briefly touched earlier this year, this marks the first time it has been maintained over a week-long period.

To grasp the scale of this achievement, 1 zettahash equals 1,000 exahashes (EH/s). Bitcoin first crossed the 1 EH/s mark in 2016. Since then, the hashrate has surged from around 800 EH/s at the beginning of 2025 to the current 1 ZH/s—a testament to the network's accelerating mining activity.

The rapid increase in hashing power is expected to trigger a significant difficulty adjustment, projected to exceed 7% in the coming days. This would rank as the second-largest upward adjustment this year. Difficulty adjustments, occurring roughly every two weeks, ensure new blocks are added to the blockchain approximately every 10 minutes, regardless of fluctuations in mining power. Post-adjustment, the difficulty level is set to rise to 138.96 trillion (T).

MicroStrategy Acquires Additional 4,408 Bitcoin for $450M Amid Stock Controversy

MicroStrategy (MSTR) has bolstered its Bitcoin holdings with the purchase of 4,048 BTC last week, spending approximately $450 million at an average price of $110,981 per coin. The acquisition raises the company's total Bitcoin stash to 636,505 BTC, valued at nearly $70 billion based on Bitcoin's current price of $109,400.

The latest buys were primarily funded through sales of common stock, alongside smaller offerings of preferred shares. This move has sparked debate among investors, as MicroStrategy previously vowed to avoid issuing shares when its mNAV ratio—a measure of stock valuation relative to Bitcoin holdings—fell below 2.5x. With the ratio now hovering around 1.5x, the company faced limited options to sustain its aggressive Bitcoin accumulation strategy.

Critics argue that issuing common stock at such a slim premium to mNAV risks diluting existing shareholders. Meanwhile, MSTR shares edged lower in premarket trading, reflecting market unease over the financing approach.

MicroStrategy's Equity Strategy Shift Reinforces Bitcoin Commitment, Analyst Says

MicroStrategy's recent share price decline has sparked criticism from retail investors, who allege Executive Chairman Michael Saylor compromised fiscal discipline by relaxing equity issuance rules. The company had previously committed to avoiding stock sales when its premium to bitcoin holdings fell below 2.5x.

Benchmark analyst Mark Palmer contends these concerns misunderstand MicroStrategy's strategic positioning. The stock's underperformance stems primarily from compressed bitcoin NAV premiums and broader crypto market volatility—not capital mismanagement. By updating its equity guidance on August 18, the company regained operational flexibility to continue accumulating BTC during market downturns.

This tactical adjustment reflects MicroStrategy's history of innovative balance sheet management. From convertible debt refinancing to pioneering bitcoin-backed preferred stock, the company has consistently developed mechanisms to sustain its bitcoin acquisition strategy without compromising long-term positioning.

MicroStrategy Doubles Down on Bitcoin with $449M Purchase, Holdings Now Worth $69.69B

MicroStrategy, led by Michael Saylor, has aggressively expanded its Bitcoin treasury with a $449.3 million purchase of 4,048 BTC at an average price of $110,981 per coin. The company now holds 636,505 BTC—worth $69.69 billion—with a cumulative investment of $46.95 billion at an average $73,765 per BTC.

The move underscores MicroStrategy’s conviction in Bitcoin as both an inflation hedge and a cornerstone of its financial strategy. The firm has achieved a 25.7% year-to-date yield on its BTC holdings in 2025, solidifying its position as a bellwether for institutional crypto adoption.

Bitcoin’s price rebound past $110,000 reflects renewed market optimism, fueled by growing mainstream acceptance. MicroStrategy’s continued accumulation signals a broader shift toward corporate embrace of digital assets as foundational investments.

Will BTC Price Hit 200000?

Based on current technical indicators and market fundamentals, reaching $200,000 represents a significant but plausible target over the medium to long term. The combination of strong institutional accumulation (MicroStrategy's recent $450M purchase), record network security (1 ZettaHash hashrate), and expanding global access creates favorable conditions. However, investors should expect volatility along the way, with key resistance levels needing to be breached.

| Key Level | Price | Significance |

|---|---|---|

| Current Price | $111,530 | Testing 20-day MA resistance |

| Next Resistance | $118,933 | Bollinger Band upper boundary |

| Target 1 | $150,000 | Psychological resistance level |

| Final Target | $200,000 | Long-term institutional adoption price |

BTCC financial analyst Emma suggests: 'While timing is uncertain, the convergence of technical strength and fundamental adoption makes $200,000 achievable, though investors should maintain a long-term perspective through inevitable market fluctuations.'